Constitutional Amendments

Amendments TL;DR:

Amendment #1 makes it easier for small business to file their sales taxes and may improve overall collections. (YES)

Amendment #2 lowers corporate taxes and removes federal and most all itemized tax deductions for individuals. (NAH)

Amendment #3 allows newer levy districts to raise property taxes (up to 5 mills) without voter approval. (NAH)

Amendment #4 use protected (dedicated) funds to fill budget shortfalls. (NAH)

Amendment #1

Electronic filing, remittance, and collection of sales tax

While we do understand the benefit of keeping ownership local, and this would remove that, we do support more user friendly interfaces for the filing of state and federal taxes for business owners. If executed similarly to legislation passed in neighboring states, this would not call for the downsizing of local offices rather streamlining for efficiency and modernization.

The two red flags with this proposal are: (1) There is not an existing piece of legislation for the implementation of this change. The legislature will need to pass a bill detailing the process. (2) The possibility for delays in disbursement of sales tax collections could negatively impact cash flow for local governments.

Amendment #2

This amendment creates a decrease in taxation for corporations and the wealthy; which usually means middle and low income households get left holding the bag.

It will eliminate the ability to deduct not only your federal taxes but also any itemized deduction other than medical expenses for ALL taxpayers. So kiss that student loan interest deduction and these other itemizations good bye on your state income tax return[1]. It also cuts the top income tax rate from 6% - 4.7% for individuals greater than net $50K.

By far, the biggest winners of Amendment #2 are the corporations benefiting from the reduced corporate and franchise tax rates (Act 396 & 389).

Act 396 would remove the federal income tax deduction for the corporate income tax and reduce the number of brackets and their associated rates.

Act 389 would eliminate any franchise tax on capital below $300,000 and reduce the rate to 2.75% on capital above $300,000.

The tax reform that would benefit us the most, is lower sales tax; not reduced corporate income tax. No thanks, Amendment #2!

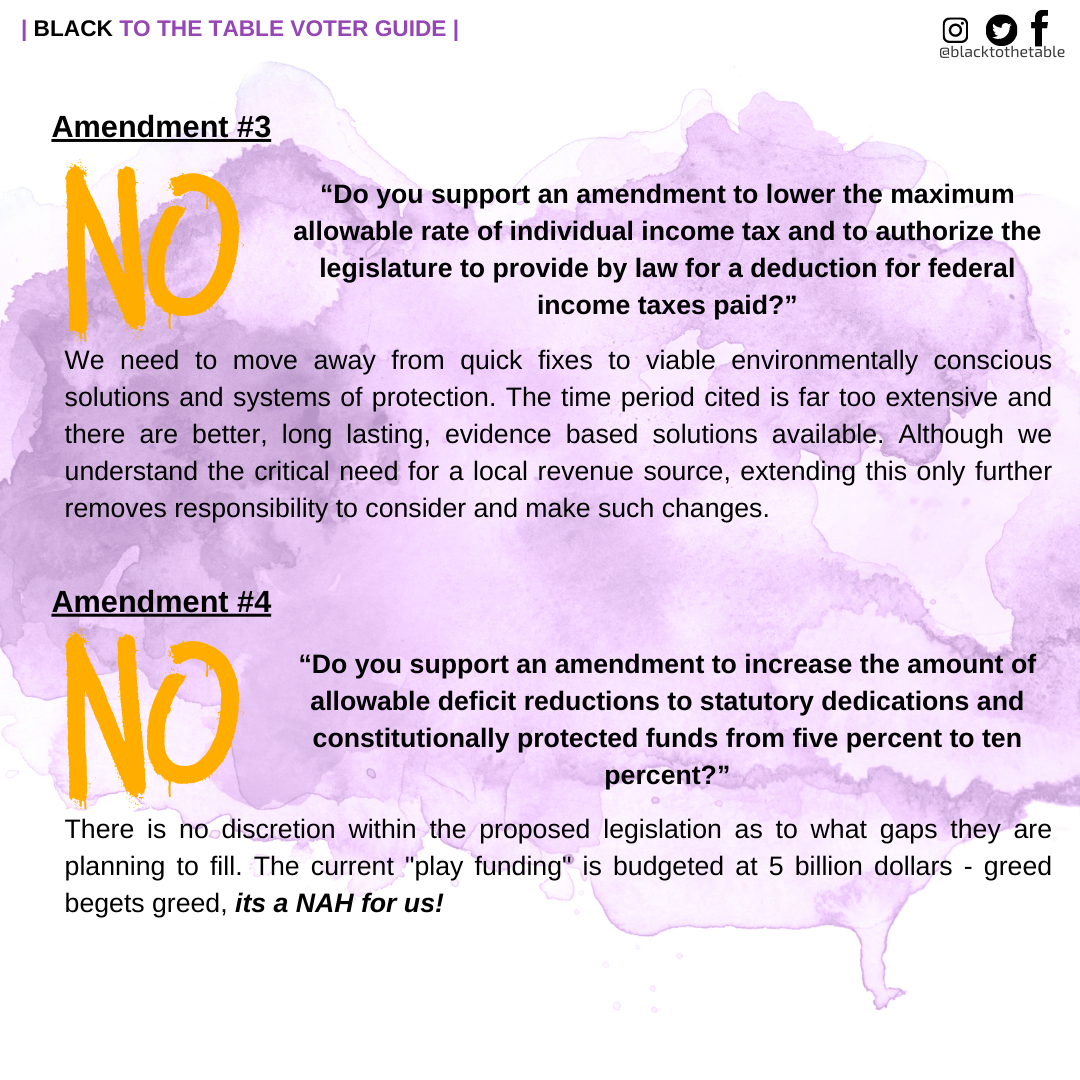

Amendment #3

Amendment #3 allows levy district boards created between Jan 1, 2006 - Oct 9, 2021 to levy a 5 mill property tax increase without seeking voter approval.

We need to move away from quick fixes to viable environmentally conscious solutions and systems of protection.

This change to the Constitution is not time-bound and there are better, long lasting, evidence based solutions available regarding combating climate change and extreme weather prevention.

Although we understand the critical need for a local revenue source, extending this only further removes responsibility to consider and make such changes.

We say No.

The five new districts that will be impacted are:

Chenier Plain Coastal Restoration and Protection Authority (Calcasieu, Cameron, and Vermilion Parishes)

Iberia Parish Levee, Hurricane and Conservation District

Squirrel Run Levee and Drainage District (IberiaParish)

St. Tammany Levee, Drainage and Conservation District

Tangipahoa Levee District

Note: To be effective in a levee district, the amendment must pass statewide and within the particular levee district. If approved statewide but not in a particular levee district, the authors intend that it will not be effective in that levee district.

Amendment #4

The state Constitution requires a balanced budget. If official state revenue projections foresee a deficit, the state must act to correct the situation and balance spending with revenue. One of these actions is to take up to 5% of each of the state’s dedicated funds and redirect the money to the state general fund.

This amendment proposes to increase the 5% cap to 10%.

It’s a case of ‘robbing Peter to pay Paul’ and doesn’t force government to be smart about spending our money.

It’s a NAH for us!